Failed Statistics

If your business uses online transactions to accept payments, then you'll know that sometimes these payments get declined.

The payment can get declined at any time, and there are numerous factors. Whatever the reason for payments getting declined, the ultimate effect is on your business.

If payments get declined, the customer will eventually get fed up and leave, and won’t purchase your product. The term we are using is declined rates.

It is the number of times a payment is denied due to any reason.

Let's dive into it.

How decline rates affect business

High decline rates are bad for your business.

Failed transactions are a part of the business; they are bound to occur when accepting credit card payments online. There are two significant reasons for credit cards getting declined.

First are insufficient funds in the account, and second is expired cards. In these specific cases, there is nothing you can do as the error is on the customer's side. Ultimately, it affects your business.

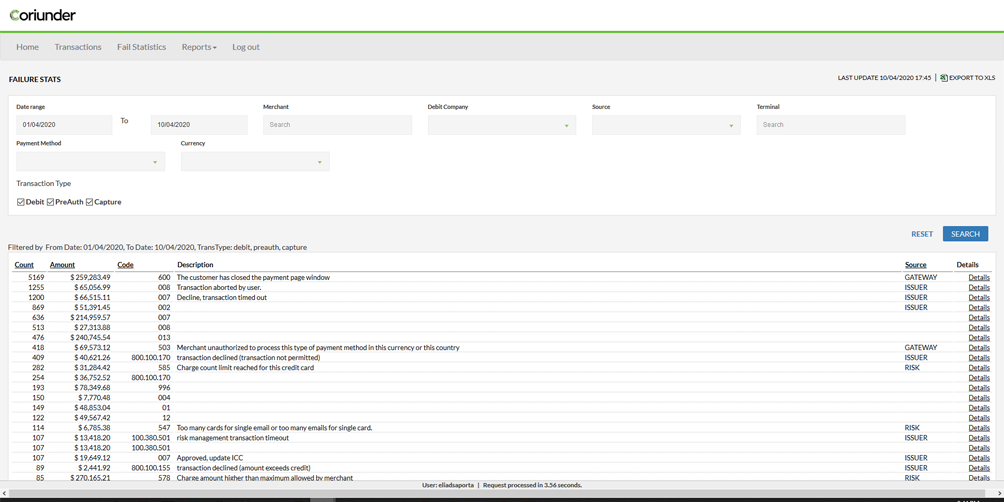

Failed Statistics Report

Failed statistics report is an excellent tool for you to analyze your decline transactions and apply solutions to increase your approval rate.

This report contains all the details you'll need to analyze why the transactions are getting declined and how many times they were declined.

The report also gives you a detailed list of all the declined reasons. You can issue a report along with all decline reasons (based on count or amount) and adjust the Merchant's processing permissions according to it.

System Decline

The majority of the system declines are caused by Admin modification.

The Admin modifies some settings which result in system declines. The Admin can analyze the modification and adjust to the important needs.

The system declines are a result of risk rules that are previously set by an admin. If you, the Admin, would like to allow the customer to process their transactions, with different limitations, you should change the risk rule.

You'll find the risk rule under the Merchant's configuration and add or modify it as you wish.

Finally, after changing the risk rule, you can let the merchant process again.

Issuer Decline

Another type of failed transactions is Issuer decline.

Issuer declines are transactions that declines by the bank.

When a transaction fails, the bank sends the reply reason why the transaction failed along with the reply code.

These reply reasons provide detailed information on the failure reason. There are numerous reasons why the bank can decline a transaction.

In some cases, the reply reasons are not very clear, so its recommended to reach the bank for further information about the reason why a particular transaction failed.

Reply Codes

Now comes the part where you need to analyze the reasons for failure to correct them, so they don't occur in the future.

You can start by analyzing the reply code and mark abnormal activity you might want to adjust, such as too many technical declines or communication issues with one of your providers.

There can be numerous reasons but start by fixing them one by one.

For instance, start by fixing the issue of communication issues with your providers. Email them to discuss the matter and resolve it. Then move on to the next.

Analyzing the traffic is beneficial and will assist both the Admin and the Merchant in improving overall performance.

The system provides you with detailed information regarding each declined transaction that went through the system.

Reply codes can be either system decline or issuer decline.

Make improvements in your overall processing

After you've worked with a bank for about 1 to 2 months, you should go over the failed statistics report once more.

You should analyze it and make necessary modifications to the processing permissions of your Merchant based on GEO, 3D, Non-3D, and Approval rate.

After going over these parameters, you can help your Merchant to increase the approval rate by modifying the processing permissions accordingly.

This can be done by routing the Merchant’s transactions to the most efficient banks based on those parameters.

You can keep analyzing these failed statistic reports each month and keep taking necessary actions on it.

Keep customizing your merchant's account based on this data.

Using those failed statistics can provide a significant advantage for your PSP.

Transaction Reports.

PREVIOUS POST

PREVIOUS POST

Rolling Reserve Reports

NEXT POST