Onboarding Portal

As a global company, you work with diverse types of merchants from all over the world. They may reside in any country.

The rules and regulations of banking may be different for each of the merchant. Similarly, your customers can be from anywhere around the world. As a global company, you'll have a reach all over the world, as your potential customers can be from any country.

Now, before they can make sales and purchase products or services, they need to be linked with your company electronically. This means the payments that will be sent and received will be digital. For this, you will have to sign up for your merchant or customer.

Onboarding

The process of someone signing up on your company is called onboarding. This is primarily done to initiate business. After onboarding, the merchants can sell their products or services, and the customers can purchase those products or services.

Onboarding is an important part of a company's journey, the easier it is to signup, the more clients you will have. The more efficient the onboarding process, the more clients will be attracted to you, and as a result, increased income.

Merchant and customer onboarding

Merchant or Customer onboarding is the preliminary process that the merchant or customer will do right after registering into your platform. Merchant onboarding usually includes Company or Personal details, KYC documents, and other information you might request.

The onboarding will ensure you to Know Your Customer (KYC) before activating their account.

His step is important as you'll have all the necessary information regarding your merchant.

Know Your Customer (KYC) documents are required from the merchants as they are important.

KYC upload

Before you ask for KYC documents you need to analyze and define what documents you need. Next, you can list the required documents for the merchant. The merchant or customer will be able to upload their KYC documents right through the Onboarding interface. The interface is user friendly and easy to navigate around.

The list of all KYC documents is big, so you can require only what you need. Here some examples for KYC documents: Passport, Utility Bill, Incorporation Documents, and more...

After the documents are uploaded, the Admin can look at them and analyze the reports. The Admin’s interface will give the option to approve or reject the KYC documents. The interface also provides you and the merchant or customer with an overview regarding their KYC status. They can see if the state is pending, accepted, or rejected.

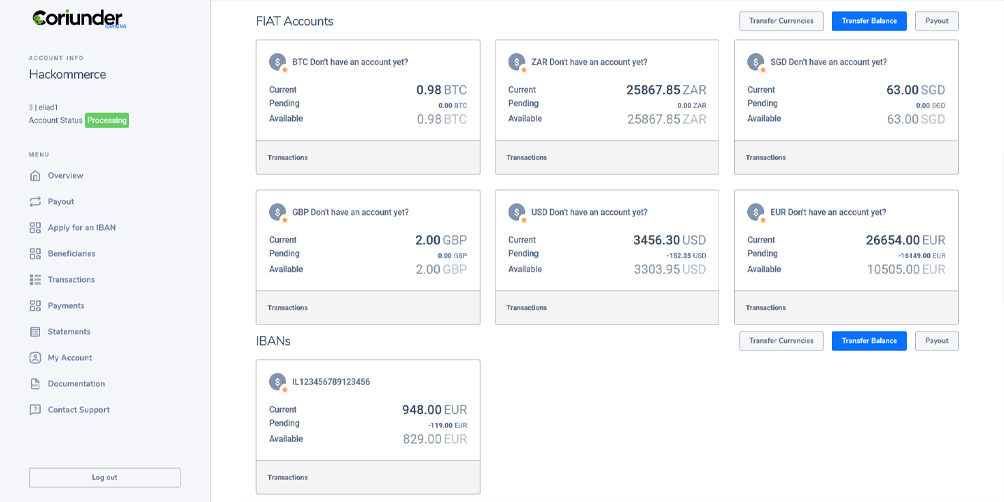

Balance transfers

It is essential to give merchants and customers access to their balance. They should also be given access to view their current balance. The interface enables your customers and merchants to take control of their balance. The interface is simple and straightforward. The easy to use nature helps merchants and customers to process payments faster.

The interface includes:

- Account balance

- Target Balance

- Transfer Amount

- Transfer Currency

- Balance transfer type

- Message box

- KYC upload

The transfer balance option allows the merchant or customer to transfer balance (in case that they have sufficient balance) from his account to other accounts registered on the platform. They can move between accounts, but they account must be registered on the platform first

Payout requests

The user can request a Payout to be made. This payout process involves transferring the balance from his balance to an external bank account, that he previously added as a beneficiary. The bank is approved first, and only then the payout process can be initiated. The payout request will eventually be approved by the Admin.

The Admin manages the requests with the Wires Management screen.

If he accepts the transaction, only then it will pass through.

Our customers use the Onboarding portal for Banking and wallet solutions, contact our support for further details about how it can fit into your business.

The Partner Control Panel

PREVIOUS POST

PREVIOUS POST

Customer Management

NEXT POST