Risk rules engine

Manage card-based limits, limit a card to a certain amount, or a count of transactions – manage blocks to prevent the cardholder from running additional transactions.

The system allows the Admin to add customized risk rules. This is divided into two main categories based on the transaction status: Passed transaction, Declined transaction.

We have the option to add as many rules as needed and to manage according to Admin and merchant’s needs.

Passed Transactions

This risk rule allows you to set the merchant limit by amount processed or number of transactions. If this limit is breached, the system will decline the transaction and it will not send it to the bank.

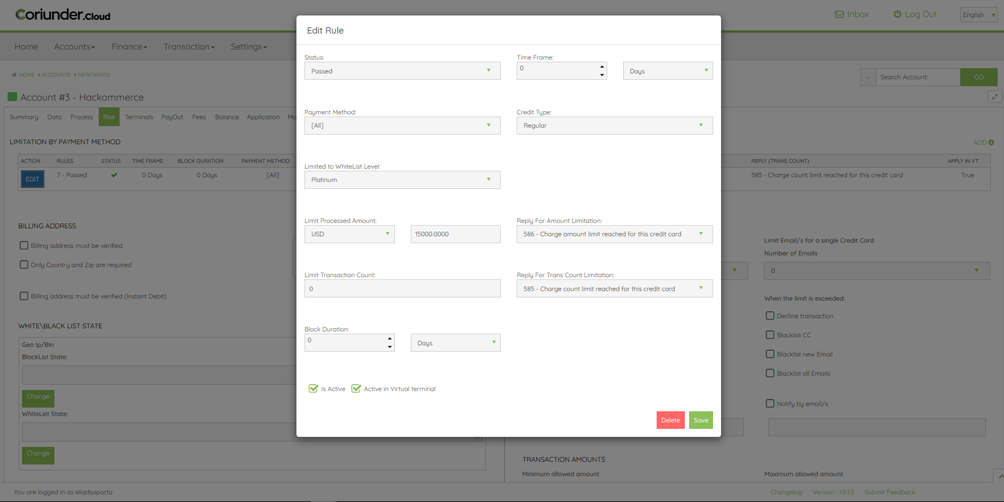

The risk rule is defined by parameters that the admin sets: Status, Time frame, Amount, Reply code, and block duration.

Decline Transactions

The Admin create risk rules for declined transactions based on the issuer’s decline rules. This rule will help you to mitigate the bank’s risk and to be more effective with your risk measurements. Those declines were received by either the issuing bank or the acquirer (to simplify, any external decline): creating a rule for this type of decline is intended to extend the period for which a card will remain blocked.

By Payment Method

Another feature is to create a risk rule according to the used Payment Method. Click add and choose the parameters for your risk rule: Status, Time frame, Payment Method, Reply Code, and Block duration.

By Transaction Type

The last option is to create a rule based on the type of transaction (Credit/Debit). You can limit the merchant to a predefined amount of Refunds or Credit transactions.

Whitelist Level

Limits are grouped under a common area which provides a structured & systematic approach for identifying risks.

The system enables the merchant to decide on their client’s risk level in the system.

In general, the merchant can give some specific customers different permissions to other clients. We have 4 different risk level categories: Bronze, Silver, Gold, Platinum.

The Admin can also choose to block the card holder’s data (Email, name, phone, BIN), choose if the block will apply to each merchant in the system or just to a specific merchant.

In addition to the customized risk rules, it is recommended to add some basic risk measurements as well.

Daily Volume Limit

This value is used to prevent an exceeding the number of transactions (as set with the merchant).

if this limit is exceeded, any transaction past the daily limit will be declined by the system.

White / Blacklist Country

Allow or block transactions based on the country in which the Customer ’s card was issued. This means that at the moment of the transaction, once the BIN number has been identified the system will decline the transaction.

White / Blacklist Geo IP

Block transactions from specific countries based on the IP address from which the cardholder is sending the request.

CC / Email limitation

The system enables the Admin to limit the number of Credit cards for a single email address and limits the number of emails for a single Credit card.

Once a limit has been set you can choose the outcome for the cardholder – block the transaction, block the card, block any future request, and more.

The risk management process is intended to support and protect you, as Payment Service Provider from possible frauds and creating Risk Rules its one of the Gateways ability to fulfill its mission.

Debit Company Management

PREVIOUS POST

PREVIOUS POST

Settlement Management

NEXT POST