Transaction management as a concept gives you the tools to monitor all of your activity and make calculated decisions given the responses you receive from the system or your partners.

Transaction Statuses

You will find 9 different transaction statuses: (Captured, Decline, Decline 3D, Pending, Authorized, Captured – Refunded, Decline – Pre-authorized, Declined – Pre-authorized – Captured.

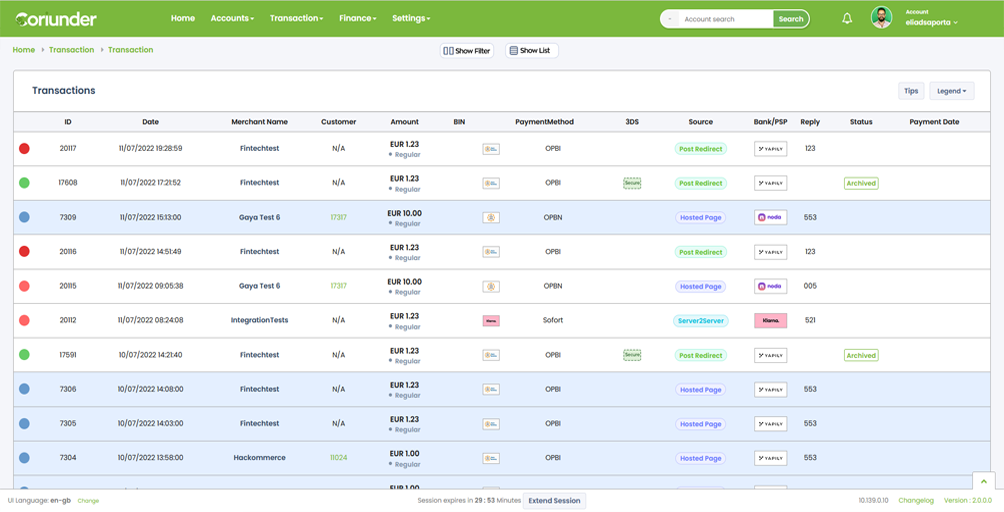

The Transaction table will provide you with general information about the transaction such as Date, Source (whether the merchant sent the transaction using the Hosted payment page integration or the Silent Post integration), Amount and Currency, BIN (Bank identification number), Payment Method (Visa, MasterCard, APM, Etc..), Merchant name, Bank or PSP that processed the transaction, Reply code (in case that it’s a decline transaction) and Settlement status (whether the Admin already settled the transaction or its still duo to the merchant).

Reply Codes

Start by analyzing the reply code and “flag” abnormal activity you might want to adjust, such as too many technical declines or communication issues with one of your providers. Analyzing the traffic will assist both the Admin and the Merchant to improve performance. The system provides you with information regarding each declined transaction that went through the system. Reply codes are either system decline or issuer decline.

System Decline

Most of the system decline is caused by the Admin modification. The Admin can check the modification and adjust to the relevant needs. System decline is a result of risk rules previously set by admin. If you, the admin, would like to enable the customer to process this transaction, change this risk rule under the merchant’s configuration and then let the merchant process again.

Issuer Decline

Issuer declines are declines by the bank. The bank sends the reply reason with the reply code, reply which provides more information on the reason for the decline. If the bank sent the bank a reply code which is not very clear to you, contact the bank with the transaction details and ask them for further clarification.

Chargeback and Retrieval request transactions

Chargeback

A chargeback is the result of a consumer disputing a charge with their bank or card issuer. In some cases, the client may see a transaction in their bank statement that they don’t recognize, or they might be unsatisfied with the product or services they paid for. In case you, as admin, received a chargeback notification from the bank, select the Chargeback reason and create the transaction.

Retrieval Request

Also called “Soft Chargeback” or “Copy Requests”. Retrieval request occurs when a consumer wants more information about a transaction or purchase. Usually, the consumer doesn’t recognize the transaction descriptor, or he can’t remember what they paid for, retrieval request will provide him with the information before filing a chargeback transaction. The merchant can dispute retrieval requests with supporting documents and in case that everything is provided and explained properly, the acquiring bank won’t credit back the consumer.

Transaction management is the core of your business and its important to review the transaction status regularly to make sure that transactions won’t go to a waste.

Settlement Management

PREVIOUS POST

PREVIOUS POST

Smart Routing

NEXT POST