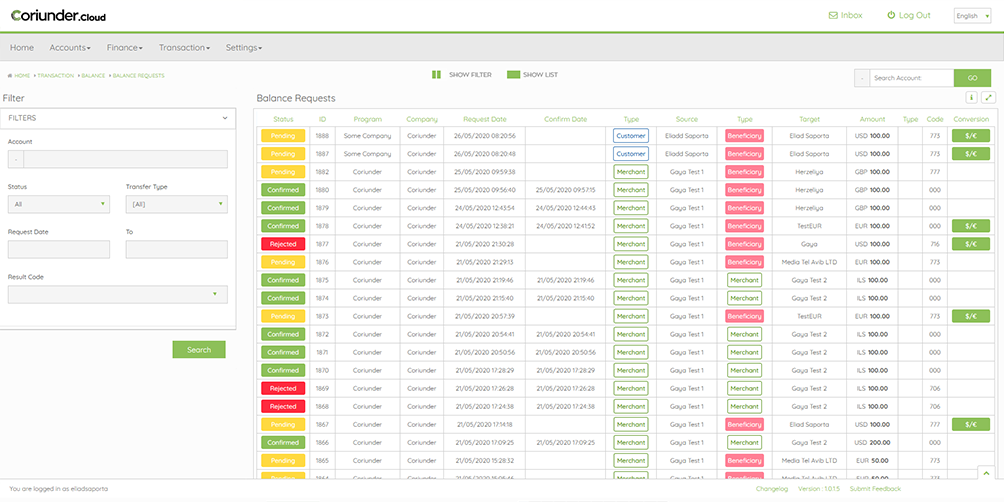

Balance Requests

All of our "Accounts" (Merchants/Corporates/Customers/Affiliates and even Banks) have a Balance account allowing them to transfer their balance freely within the system and even request to transfer to a third-party beneficiary if needed.

Transfer Balance

The process of transferring funds using your digital wallet depends on one important factor - the source and target of funds.

At first, the customer is depositing funds into his wallet.

These funds are usually transferred into the digital wallet via different online payment methods such as bank transfers, credit card payments, or transfers from other digital wallets.

Basically, enable money transfers between Customers and Merchants internally within the system and provide your customers with the option to Cash-out and transfer their balance externally.

Internal Transfer

When a Customer or Merchant wishes to make a purchase using their stored funds, they can execute an internal transfer (if the payee is holding a wallet at the same provider), Behind the scenes, no funds are moved - the digital wallet provider (which is you, as admin) simply debiting the payer with the request amount and fees, and crediting the payee.

External Transfer

In addition to internal transfers, your customers can request for a payout to a 3rd party account.

In that scenario, the customer is adding and storing the beneficiary (payee) details in a specific form, according to the provider needs. One of the bank details are stored in the system; the customer can ask for a payout to that beneficiary and upload the supporting documents for those requests.

External transfers are subject to the admin’s approval and will be executed once the team has reviewed and made sure that the payout request stands in the wallet requirements.

Transfer Limits

The system allows you to limit your customers and merchant from transferring funds beyond the limits you set.

Those limits can be set on an action level, such as: - Minimum and Maximum per balance request. - Daily amount limit - Daily monthly limit - Blacklisted countries - Affiliate Transfers - Merchant Transfers

In case that one of those limits is breached, the customer payout request will be directed to the Balance Request page, and the admins will get the option to either reject the request or approve it although it crossed the configured limit

For example, the configured daily limit is 1,000 USD and your customer already did 1 payot request of 600 USD, but he has another urgent request of the amount 500 USD. Meaning, the limit is breached. You as admin can decide that this 100 USD crossing is ok with you and you can approve the request although the limit is breached.

Currency Conversion Balance Requests

The system enables the wallet provider the ability to control the supported currencies for the wallet. All merchants and customers associated with the specific signup program will be limited to the predefined currencies.

The customers can use this feature to convert currencies with their accounts and process requests using the converted currency, or they can directly as for a request in a currency that they don’t have any balance with and the system will convert the balance request to the desired currency.

The admin can manage those currencies, add conversion fees, spreads, and control the rates.

Schedule a call with one of our team to find out all digital wallet functionalities.

Failed Statistics

PREVIOUS POST

PREVIOUS POST

The Partner Control Panel

NEXT POST