Currency Conversion

As a business owner or an Admin, you are responsible for receiving transactions. Certain factors need to be defined before a transaction is processed.

The Admin and the merchant can use different currencies of their local country.

Admin interface automatically pulls conversion rates daily and gives you and your merchants the ability to process in different currencies all over the world.

As admin, you can edit the conversion rates and add a fee or spread according to your needs.

Multi-Currency Processing

If your business or company is global, then your potential customers can be from any country.

With globalization, now your company is not limited to sell only within their country but to target and sell to customers worldwide. The merchant can be located in a specific country and sell its services or products worldwide with local currencies.

For this reason, you should be prepared to accept payments from any type and accept all currencies. Limiting your payment options will eventually limit potential customers. This is where multi-currency processing comes in.

Multi-currency payment processing occurs when your business can accept credit cards from end customers in different currencies.

Using the Multi-currency processing feature, you can provide your merchants with the options to display their customers the purchase cost in their local currency in addition to your local currency as a business.

Using this feature, you can charge credit cards in the currency of your choice and open your business to boarded regions all over the world.

Earn additional commission

Currency conversions are very likely to occur so it can be another way for you as a PSP to earn additional commissions.

You can add conversion fees and spread within the system and charge your merchant accordingly with any action they take.

The spread, (the difference) between the bid and ask price for a currency in the e-commerce market can be large, and might change between one provider to another, so “locking” spread and fees will ensure that you won’t lose while taking actions with more than one currency.

Utilize this to your financial advantage. You can add a conversion fee and receive revenue from the exchange commission taken by the bank. This way, you can conduct your business transactions while earning small amounts form conversion rates.

Ultimately, you’ll increase your profits in the long run.

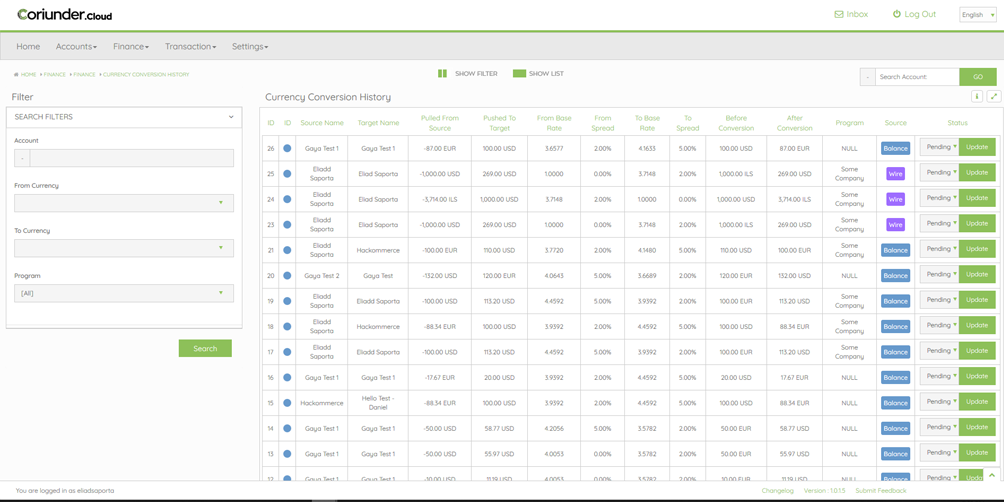

Currency Conversion History

Currency conversion history feature mainly used for internal tracking of your PSP regarding all the conversion fees that took place.

The system will display each one of the actions with currency conversion and you can mark those actions with Pending, Converted, Sent according to the actual status of the funds.

For example, your client converted funds between his accounts and later he would like to send the converted amount to a 3rd party account.

Pending means that you as admin, still didn’t purchase the currency you just sold to your client.

Converted means, that you purchased the actual currency that you sold.

Sent means, that you executed the converted amount to 3rd party account.

Use this feature to understand exactly where you stand at all times in terms of currency exchanges.

Contact us to discuss the specifics of your business and learn more about the currency conversion role in the Gateway system.

Smart Routing

PREVIOUS POST

PREVIOUS POST

Limited Sub Accounts

NEXT POST